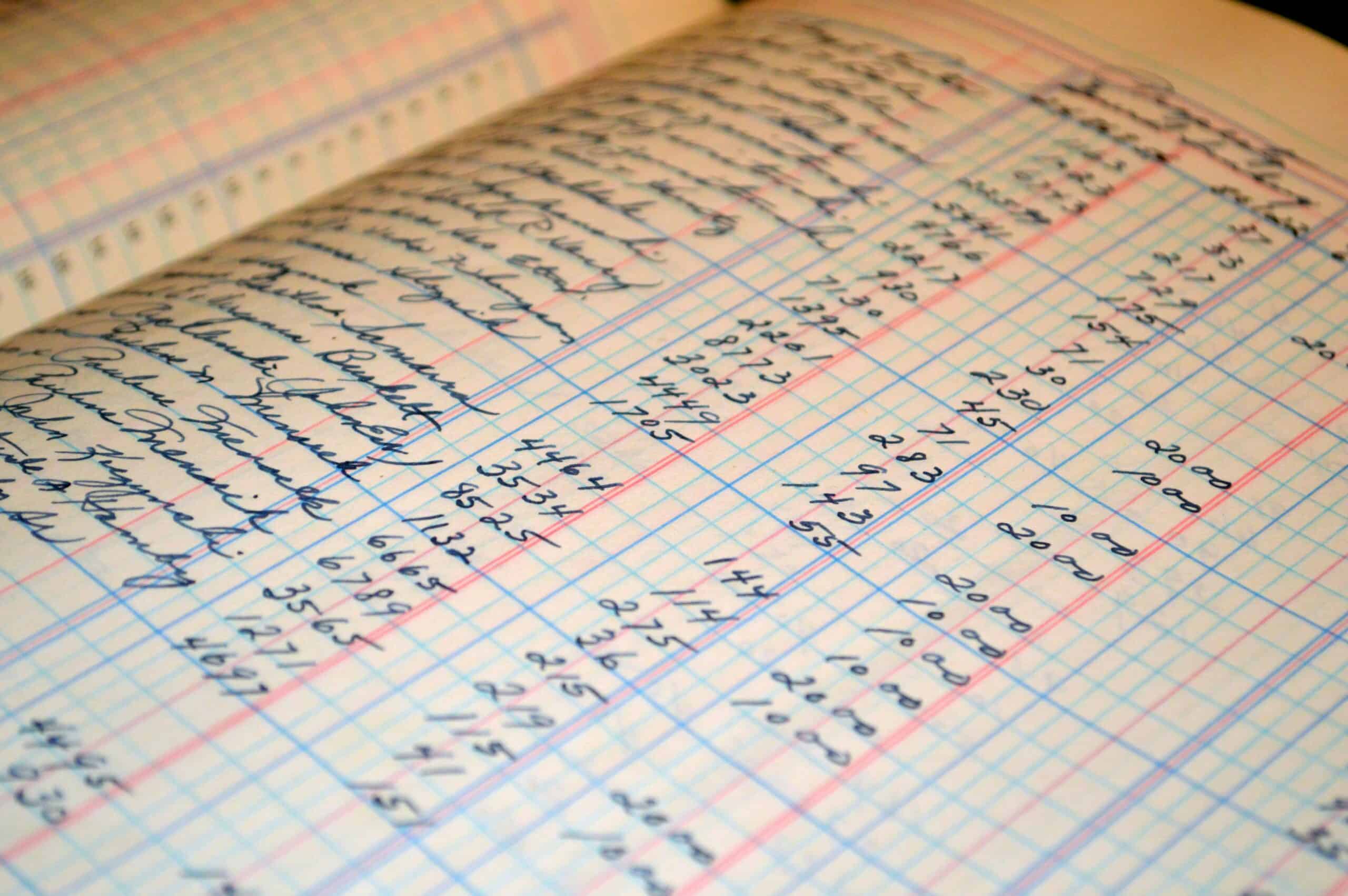

Bookkeeping Best Practices for Woolwich Entrepreneurs

As an entrepreneur, maintaining accurate and up-to-date financial records is crucial for the success of your business. Whether you’re just starting out or managing a growing business, effective bookkeeping allows you to stay on top of your finances, avoid costly errors, and comply with HMRC regulations.